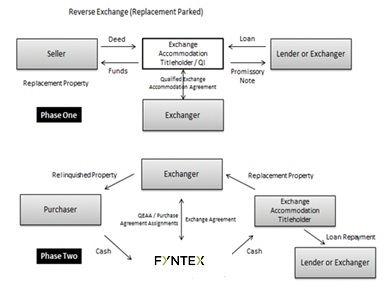

41 reverse 1031 exchange diagram

15:18Provided for by IRS Revenue Procedure 2000-37 (Rev. Proc. 2000-37), reverse 1031 exchanges allow ...12 May 2016 · Uploaded by Accruit 1031 Reverse Exchange Diagram Method 1. The above information is provided for general information purposes only. You should discuss your actual individual property transaction with your current attorney, certified public accountant or us. We hope you find the above information helpful.

3 Jun 2019 — 8 Steps to Perform a Reverse 1031 Exchange · Find a replacement property. · Enter into a qualified exchange accommodation agreement. · The EAT ...

Reverse 1031 exchange diagram

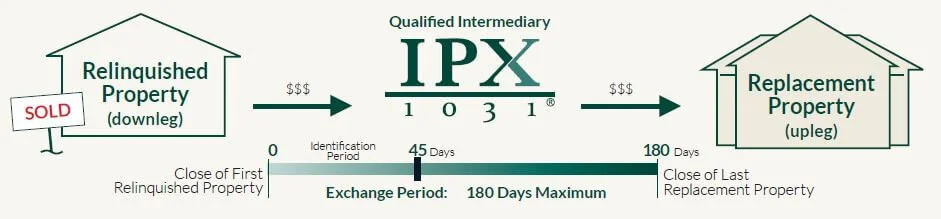

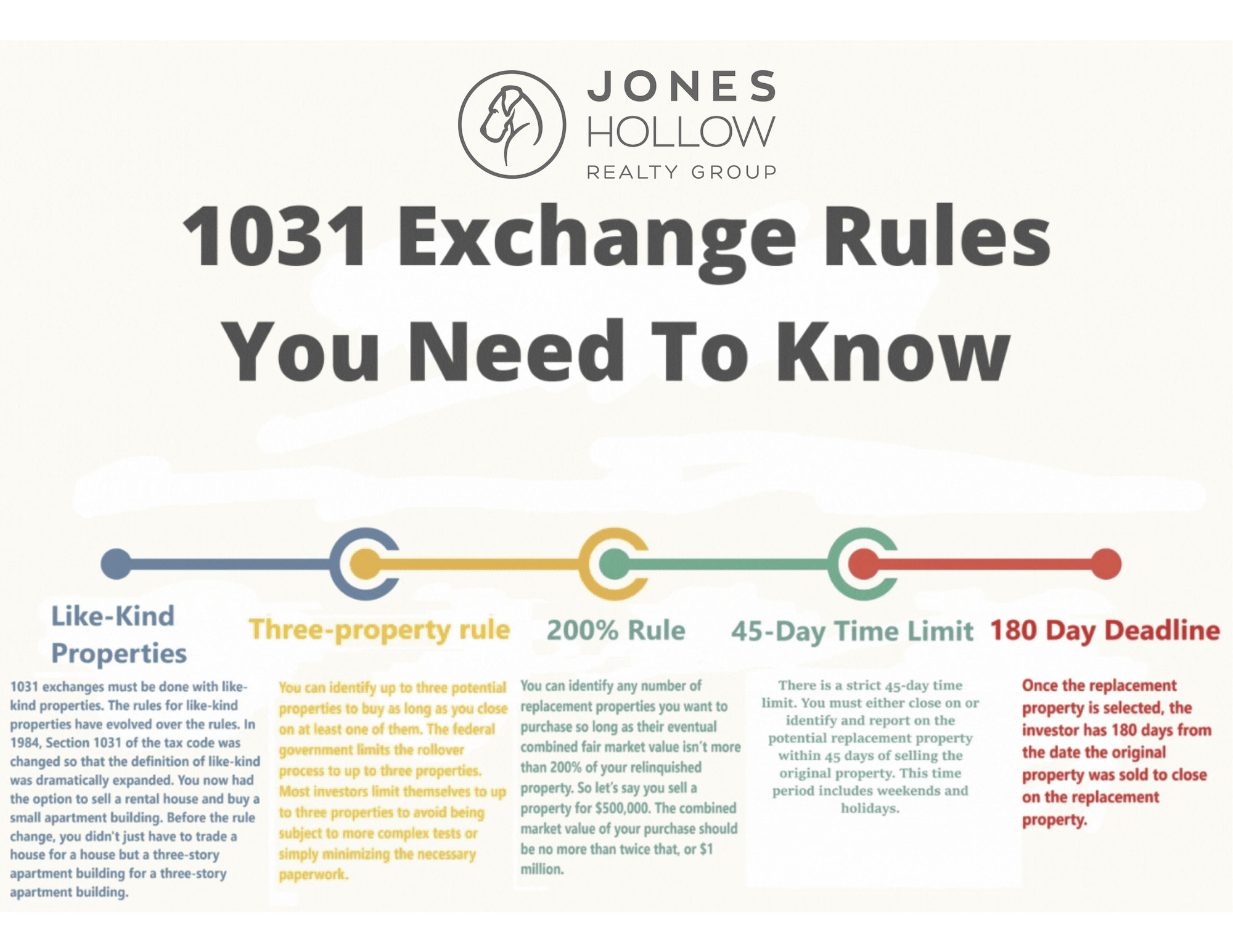

Reverse 1031 Exchange Time Periods. The same 45 day Identification Period and 180 day Exchange Period deadlines of IRC §1031 apply to a safe harbor reverse exchange under Rev. Proc. 2000-37, with a slight tweak. If the EAT has begun the exchange by acquiring the Replacement Property, then the Exchanger must identify within 45 days after the ... Reverse 1031 Exchange Diagram. Rules governing reverse exchanges are complex. Learn what it takes to qualify from the Equity Advantage experts - exchange facilitators since INTRODUCTION Many investors are aware of their ability to use a reverse exchange when they are faced with having to close on their replacement. 3. Reverse 1031 exchange. As the name suggests, a reverse 1031 tax-deferred exchange follows the opposite process that a delayed 1031 exchange does. In a reverse exchange you acquire the replacement property before the relinquished property is sold. However, you can’t take actual possession of the replacement property until the entire 1031 ...

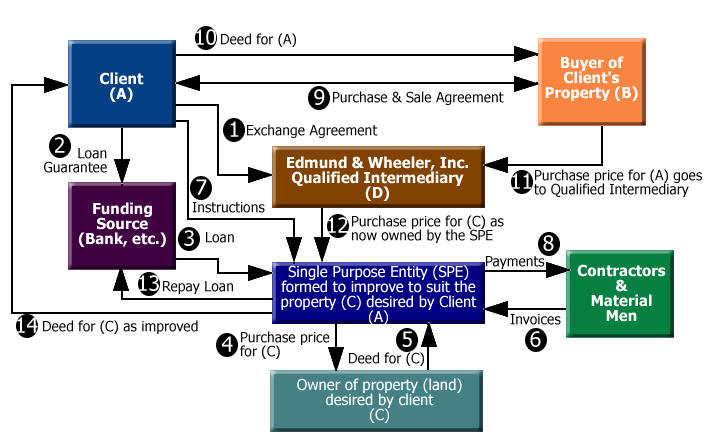

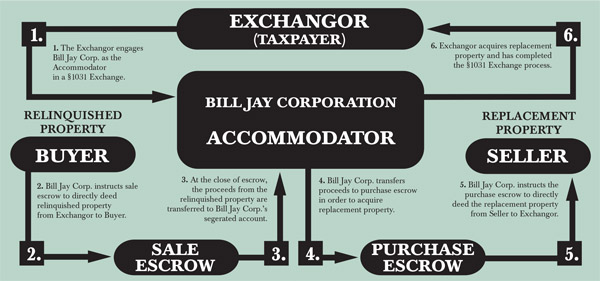

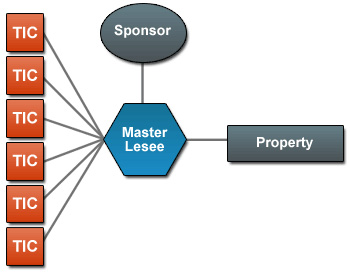

Reverse 1031 exchange diagram. A reverse 1031 exchange is just that–the process of a 1031 exchange, but reversed. With a reverse exchange, an investor can buy a replacement property first, and then sell their existing property after that. It sounds straightforward, but there are certain guidelines investors must follow, outlined by the IRS. In a reverse 1031 exchange, the Exchangor cannot hold title to both properties at the same time, so an Exchange Accommodator Titleholder (EAT) is created to ... View the entire 10 Steps of a Reverse Exchange Infographic here.. Accruit, LLC is a national provider of 1031 Exchange Qualified Intermediary (QI) and Also referred to as an "EAT", is typically a special purpose, limited-liability company that is used to own the legal title to property that is being parked as part of a reverse exchange. An exchange accommodation titleholder may not be a ... Reverse 1031 Exchanges are more complicated and costly, so you need to review the amount of depreciation recapture and capital gain income tax liabilities being deferred to ensure that the cost of the Reverse 1031 Exchange transaction is justified. We would be happy to provide you with a written Reverse 1031 Exchange fee quote so that you know ...

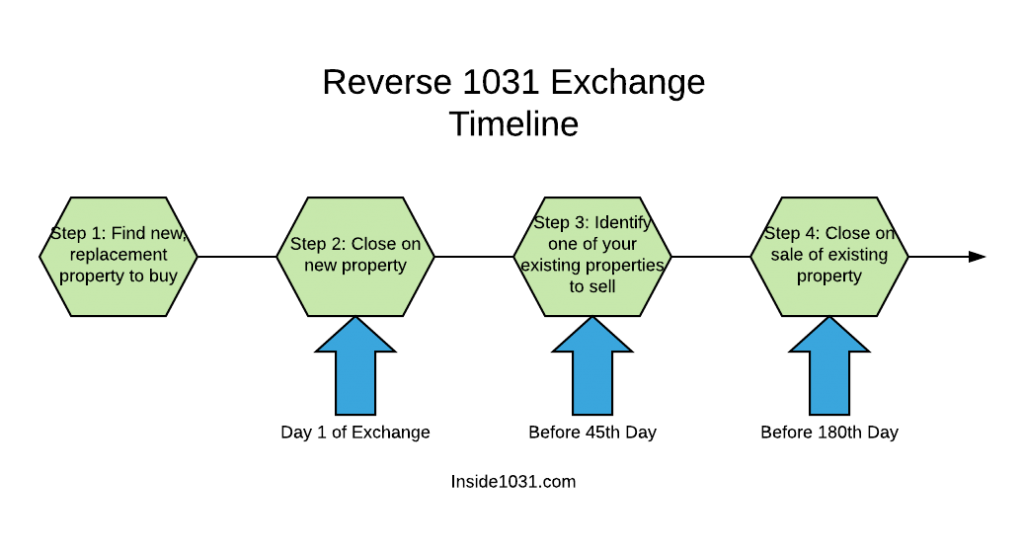

IRS Form 8824 Guidance with a Reverse 1031 Exchange . The first thing you need to do throw out the term reverse 1031 exchange. It is really not a reverse 1031 exchange. A true reverse 1031 exchange would mean that you could acquire and receive title to like-kind replacement property and then subsequently sell and convey title to the ... If you would like to find out about the reverse exchange process or the tax deferred exchange process, contact one of our experts today. We want to help your 1031 exchange transaction go as smoothly as possible. REVERSE EXCHANGE. The Reverse Exchange is structured primarily with Revenue Procedure 2000-37 in mind. Reverse exchanges apply only to Section 1031 property, so it is also referred to as a 1031 exchange. Section 1031 properties are properties that businesses or ... A reverse 1031 exchange, a reverse like-kind exchange, and even a reverse Starker exchange are all different terms for the same process. Diagram of a reverse 1031 exchange timeline This reverse 1031 exchange diagram illustrates how a reverse 1031 exchange unfolds, including what happens at each step of the exchange and all the relevant deadlines.

3. Reverse 1031 exchange. As the name suggests, a reverse 1031 tax-deferred exchange follows the opposite process that a delayed 1031 exchange does. In a reverse exchange you acquire the replacement property before the relinquished property is sold. However, you can’t take actual possession of the replacement property until the entire 1031 ... Reverse 1031 Exchange Diagram. Rules governing reverse exchanges are complex. Learn what it takes to qualify from the Equity Advantage experts - exchange facilitators since INTRODUCTION Many investors are aware of their ability to use a reverse exchange when they are faced with having to close on their replacement. Reverse 1031 Exchange Time Periods. The same 45 day Identification Period and 180 day Exchange Period deadlines of IRC §1031 apply to a safe harbor reverse exchange under Rev. Proc. 2000-37, with a slight tweak. If the EAT has begun the exchange by acquiring the Replacement Property, then the Exchanger must identify within 45 days after the ...

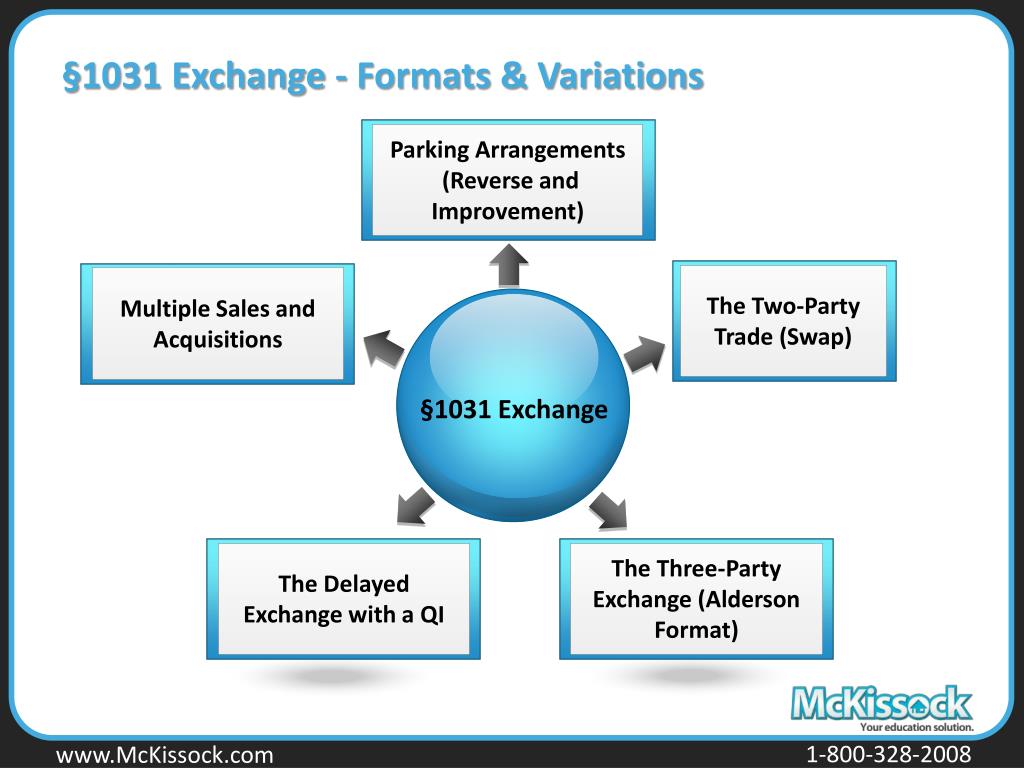

Deferred Like Kind Exchanges What Is A 1031 Exchange No Gain Or Loss Shall Be Recognized On The Exchange Of Property Held For Productive Use Ppt Download

1031 Exchange Trends And Info For 2021 Kyle Williams Ipx1031 Helping Families Buy And Sell To Upsize To The Home Of Their Dreams

0 Response to "41 reverse 1031 exchange diagram"

Post a Comment